For Coinbase it was the best of weeks and the worst of weeks- all wrapped into one. Let’s lead with the positive- last Monday S&P Global announced that it was adding Coinbase to its benchmark S&P 500 stock index. This marks a watershed moment for the crypto sector, a major psychological milestone signifying the mainstreaming of an industry that not long ago seemed on the ropes as a result of multiple scandals and depressed asset prices.

Keep pace with the rapidly evolving fintech industry by subscribing to the BIGcast Network.

Get weekly insights from industry leaders John Best and Glen Sarvady, delivered straight to your preferred podcast platform. Join our community and stay informed about the latest trends shaping the credit union industry. Subscribe today and ensure you’re always ahead of the curve.

Media

Recapping this month’s Finovate Spring event, Glen connects with Steven Ramirez (Beyond the Arc) and Elias Kruger (Long Range AI) to compare notes on the standouts and key takeaways- such as agentic AI- from San Diego. Also- Coinbase packs a year’s news into a single week, and Nevada looks to enter the payments fray.

Glen connects with Paylume’s Andrew Gomez to unpack the burgeoning pay by bank model, explore lessons learned from other countries’ rollouts, and consider the pros and cons facing banks and credit unions. Also- a possible open banking do-over, more stadium naming rights, and resisting the urge to spike the ball before the goal line.

In this session, we discussed the latest wave of credit union mergers, shakeups at the NCUA, shifting economic indicators, and other headlines that have been making waves across the industry. We explored what these developments could mean for your strategy, your members, and the future of the credit union movement.

A pair of conversations from last week’s Smarter Faster Payments conference- Glen’s annual check-in with Nacha CEO Jane Larimer, and PASA CEO Ghita Erling shares insights on modernizing South Africa’s payment system through collaboration rather than mandate. Also- AI shopping agents, Uber discovers paper, and the vultures swirl around checks.

Continuing our NACUSO Reimagine coverage, Glen speaks with Silvur founder Rhian Horgan about the “social journey of retirement” and how credit unions can play to their strengths in transitioning their biggest borrowers into their biggest depositors. Also- more of John’s conversation with cybersecurity expert Emma Zaballos about DeepSeek’s rise and the broader operational concerns around AI.

It was a fascinating week to be in the presence of 500 credit union leaders at NACUSO’s Reimagine conference. After all, the internal machinations of an obscure federal financial insurance/supervisory agency aren’t exactly headline fodder for the general public. To the industry professionals assembled in Vegas, however, it was clear a seismic shift had occurred. (Despite our lighthearted title let me be clear- this is no laughing matter.)

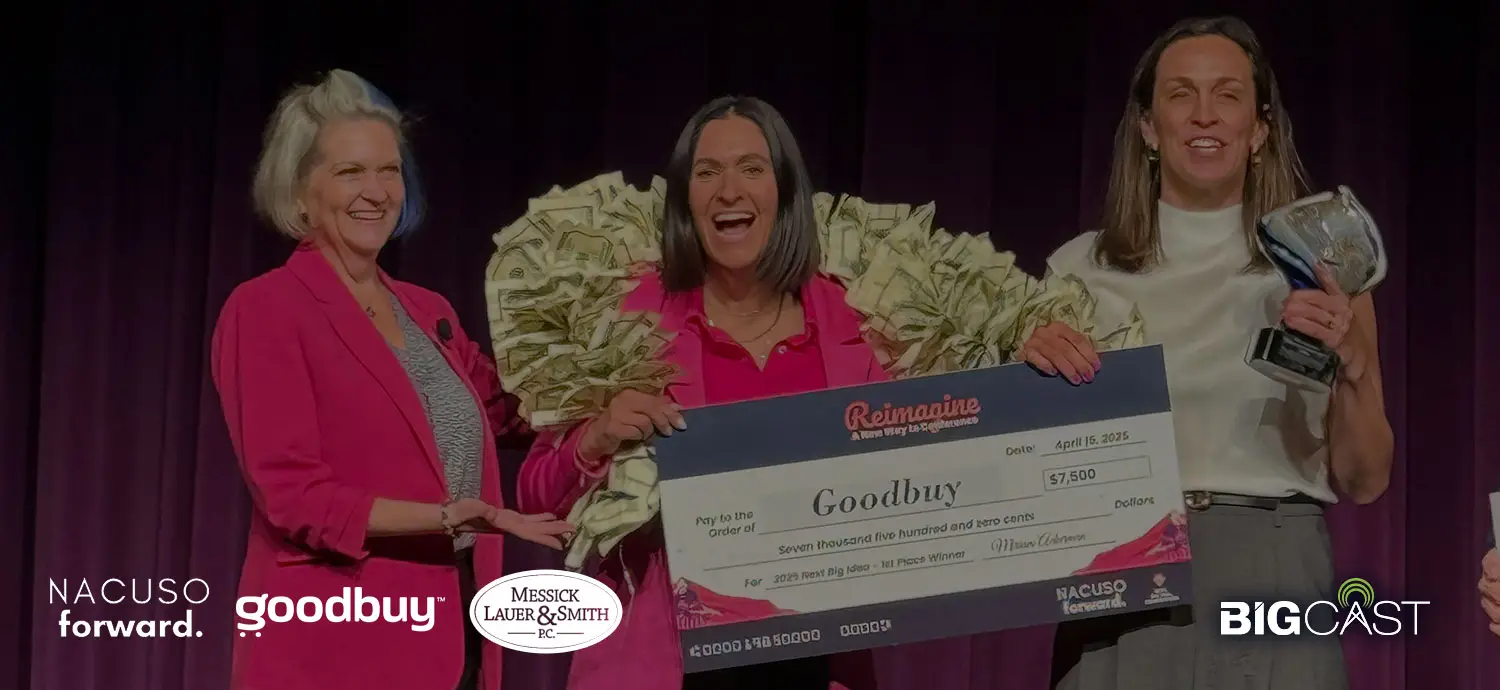

Live from NACUSO’s Reimagine conference Glen speaks with the co-founders of Next Big Idea competition winner Goodbuy Cara Oppenheimer and Cary Fortin. CUSO lawyer Brian Lauer shares his insights on the rapidly evolving regulatory landscape, and then as if on cue the tectonic plates shift….

John Best sits down with Emma Zaballos, cybersecurity expert and Product Marketing Manager at CyCognito, to unpack one of the biggest surprises in generative AI: the emergence of China's DeepSeek. Emma and John dive deep (pun intended) into the implications of DeepSeek’s rise, the broader cybersecurity concerns around AI, and what it all means for credit unions and financial institutions navigating the AI landscape.

In this session, we discussed the FDIC’s recent decision to ease restrictions on cryptocurrency activities for financial institutions and its impact on credit unions. With prior approval no longer required, credit unions have new opportunities to explore crypto services—but also face risks like market volatility, security threats, and regulatory uncertainty. Join us as we break down the key challenges, benefits, and compliance strategies for navigating this evolving landscape.

The number of Executive Orders emerging from President Trump’s Oval Office has been unprecedented. Many have been far-reaching and, in the eyes of some, over-reaching. Others have been just… weird. March 25’s EO mandating that the Federal Government cease issuing paper checks falls in the latter category.

Glen speaks with Nacha’s Stephanie Prebish and Devon Marsh about the upcoming Smarter Faster Payments conference in New Orleans, as well as Same Day ACH’s remarkable sustained growth and the rising tide that lifts all riverboats. Also- First reflections on Americas Credit Unions’ leadership change, and… No Tariff Talk!

Meet The BIGcast Network

The fintech industry is evolving rapidly, and the BIGcast is here to delve into its impact on the credit union industry. Our esteemed guests from across the financial, technology and security sectors will provide thrilling perspectives on the latest fintech innovations that are poised to revolutionize the way we handle our finances. Each week join thought-leader, John Best and subject matter expert, Glen Sarvady as they take a quick dive into the financial industry’s current breakthroughs and latest hot topics.

John Best

CEO, Best Innovation Group

Glen Sarvady

Managing Principal, 154 Advisors