Keep pace with the rapidly evolving fintech industry by subscribing to the BIGcast Network. Get weekly insights from industry leaders John Best and Glen Sarvady, delivered straight to your preferred podcast platform. Join our community and stay informed about the latest trends shaping the credit union industry. Subscribe today and ensure you’re always ahead of the curve.

Lead Scoring – Getting to know your members

Many Credit Unions measure the success of a marketing campaign solely with “home run” metrics. For example, a car loan promotion is measured in number car loans booked, and a credit-card campaign in the number of cards delivered. While there is no question that won/loss metrics are important, there is a middle ground that can give you richer customer information as you work to build member relationships rather than just achieve sales. At CU 2.0, we train our clients to use this technique, called lead scoring, as part of their digital transformation.

What is Lead Scoring?

In a typical Marketing/Sales environment, lead scoring is a system for ranking prospects against a scale that represents the perceived value each lead represents to the organization. The resulting score determines which leads the Marketing and Sales departments will engage, in order of priority. For example, a lead with a high score that indicates the lead is ready to make a large purchase soon might be handed off to a regional salesperson, while a lead with a low score is put in a Marketing “nurturing” campaign.

In a Credit Union environment, we see lead scoring as a way to track and enhance the relationship between the Credit Union and the member. Most Credit Union missions include improving the financial well-being of their members in addition to “making sales.” Credit Unions can use lead scoring to track a sales cycle and also to track a member’s financial journey and the strength of the relationship with the credit union.

By using all data from a campaign, and analyzing actions taken by members over time, we can develop a comprehensive ability to further serve the membership of our Credit Unions. By tracking a member’s actions (and lack of action) and assigning a “score,” we can offer more relevant information to help members take advantage of the knowledge and expertise at your credit union.

How Does Lead Scoring Work?

We’ve found that specific scoring methods are unique to each Credit Union, but the general idea is the same. As a member participates in email campaigns they accumulate “points.” In a typical sales environment, the points tell where the “prospect” is in your sales process–your lead funnel.

A Credit Union might modify their scoring system to account for financial lifecycle (first car, first house, etc.), financial health, the closeness of the relationship in terms of the number of products owned (or years of membership), or any other measures that help the credit union assess the member relationship. Each action a member takes helps you understand what specific information you can offer them. Sure, having them close on a car loan is great, but what if they simply aren’t ready? If they’ve shown some level of interest, it’s better to put them in a follow-on campaign rather than starting at square one.

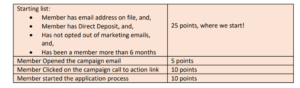

Here is a simplified example of the car loan lead scoring:

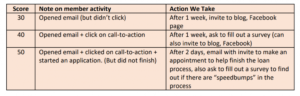

Just by receiving the email (it didn’t bounce!), the member starts at a lead score of 25. In this example, the maximum score is 50, so we could have behavioral scores and associated next-step actions that look like this:

By providing intermediate actions and involving members in blogs, surveys, and other activities, we provide better service and fulfill our mission of providing financial health information to our members. We’re also going to monitor the follow-on campaigns and update their scores based on continued interactions. You can see that we quickly have a web of online interactions, and the lead score is our key indicator for assessing the overall relationship.

Monitoring campaigns and customer interactions at this level of detail can be more work but is definitely worth the effort in the digital era. Think of this process as a way to improve customer engagement online, in the same way, that you might add a branch to be closer to your customers in the real world. The cost is less than branch operations and allows the member to engage with you at their convenient time – even when branches are not open. Digital engagement requires the same commitment to managing the data as Credit Unions have shown in managing branches. The new digital world that our members have become accustomed to leaves little choice!

Source:

Credit Union 2.0 began as an innovative digital strategy playbook, Credit Union 2.0, written by Kirk Drake and has evolved into a full service digital credit union consultancy that specializes in developing meaningful digital brands. We don’t just come up with what’s cool. We give credit unions the tools, playbook, and strategies they need to make a real impact and engage their members.