Keep pace with the rapidly evolving fintech industry by subscribing to the BIGcast Network. Get weekly insights from industry leaders John Best and Glen Sarvady, delivered straight to your preferred podcast platform. Join our community and stay informed about the latest trends shaping the credit union industry. Subscribe today and ensure you’re always ahead of the curve.

Finding Your Digital & Data Strategy Foundation Starts Here

Digital transformation has revolutionized retail banking and data is the jet fuel for the seismic shift in the credit union business model. A data strategy is foundational for credit unions to compete in today’s digital world and is required to effectively implement a holistic platform of enhanced analytical decisioning. Business Intelligence and analytics (all powered by data) are cultural shifts analogous to moving from ledger cards to core technology platforms.

While most of the industry understands the need to adopt a data strategy not everyone has reached that level of organizational commitment that is now required to compete for today’s digitally engaged consumer. Luckily, BIG Consulting and OnApproach have come together to conduct the second Semi-Annual Credit Union Industry Survey on trends in data analytics. It was completed during July and August of 2018 and follows our initial research completed in December of 2017.

Executive Summary

One-third of the credit union industry has holistically embraced data as strategically important.

The credit union industry is segmented into approximate thirds in how it views the importance of data.

1/3 of credit unions have a data strategy and are attacking the challenge holistically.

1/3 are moving forward slowly on a more departmental or project-by-project basis.

1/3 do not view data as important to their business strategy.

On one hand, 2/3 of the CUs surveyed understands that data is an important resource of competitive value and that data is being effectively used by FinTechs, BigTechs, and banks to compete for member business. Albeit, the industry acknowledges that its two or more years behind their competitors’ use of data as a competitive tool while BIG’s view is that the competitors are likely to be even further ahead. These credit unions understand that to better serve members, grow new accounts, add loans and make better decisions, data is a strategic asset; a virtual pot of gold buried in their tech architecture and behind their cultures.

On the other hand, many credit unions are not prioritizing data as an asset and/or do not see the need to move with any urgency. At least a 1/3 the credit unions surveyed are not prioritizing data strategies, nor have made plans to move forward with data analytics. BIG believes that the trailing 1/3 is going against every trend in the marketplace and will likely struggle to compete in the future.

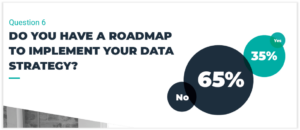

Even within the 2/3 of the credit unions who recognize the strategic value of data, most have not established data cross-functional data strategies or organizational roadmaps. As an example, there was a surprising downward trend in CUs articulating a data strategy (55% in ‘17 and 42% in ‘18), with only 35% of CUs having created a roadmap and fully 60% of credit unions seeing implementation taking 2 or more years or do not have a timeline in mind.

BIG’s bottom line view is that 1/2 to 2/3 of the CU industry isn’t moving aggressively enough to compete in today’s data-driven competitive battlefield.

Survey Results

The somewhat startling findings in Q3 and Q6 of the survey suggests that the majority of credit unions do not have a plan for data. This is particularly surprising given that 62% of credit unions are investing in analytics. In Q3 only 42% have articulated a strategy, which declined from 55% in 12/17, and 35% have created a roadmap (Q6). This suggests a “fire, aim strategy” which can prove to be ineffective and/or a waste time and money.

Q5 shows a significant improvement in the urgency of implementation of data strategies from 12/17 to 6/18. In our last survey, 35% of CUs planned on implementing their data strategy in two years or less, in 6/18 42% of credit unions are implementing their data plans within 2 years. Still, there are concerns as 33% of credit unions plan to implement their data strategy in 3 plus years and fully 25% have set no timeline at all.

Q8 is new in ‘18 and provides an interesting view of prioritization of data strategies. 37% of CUs see their adoption of analytics as a high priority, another 37% as medium and 1/3 do not see data as important. A 1/3, 1/3 and 1/3 segmentation.

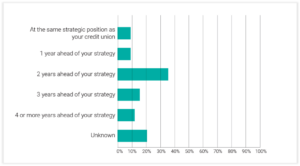

Q9 provides a new and important insight as CUs are acknowledging that they are behind their competitors. Less than 10% believe they are in a competitively equal position with banks and FinTechs. While 60% say, they are 2 or more years behind and 20% have no opinion. This should be a wake-up call for the industry.

BIG’s research on the use of data throughout financial resources suggests that credit unions may be even further behind their competitors than they acknowledge. Banks and FinTechs have been heavily investing in big data, business intelligence (part of their cultures for decades), analytic tools, artificial intelligence, machine learning and now bots. We view data strategies on a continuum of 5 levels and view 90% of credit unions in stage 1 or 2 and most large banks and FinTechs are at level 4 or 5.

Conclusions

Credit Unions are just beginning to understand the strategic link between being digitally competitive and the effective use of data for business intelligence. One-third of the credit unions are aggressively moving forward and trying to catch up with the banking and FinTech competitors who have essentially recreated the banking business model based on digital interactions fueled with ever increasing data feeds. Another one-third understand the need to use data but have not yet formulated a holistic strategy. Unfortunately, there is also a third who believes that data isn’t a competitive requirement and may soon face losing market share.

The industry is behind but has time to catch up. While digital and data strategies may be a challenge they also level the playing field and allow for credit unions to compete in new markets, member segments, marketing channels and at levels of financial sophistication that have never been available to the industry.

BIG Consulting offers a holistic data strategy assessment service that will create a data strategy roadmap for your credit union within two months and that defines a cultural alignment process that will allow your organization to win market share and serve your members better than any other banking provider.

Please go to Big-fintech.com to get the full survey.